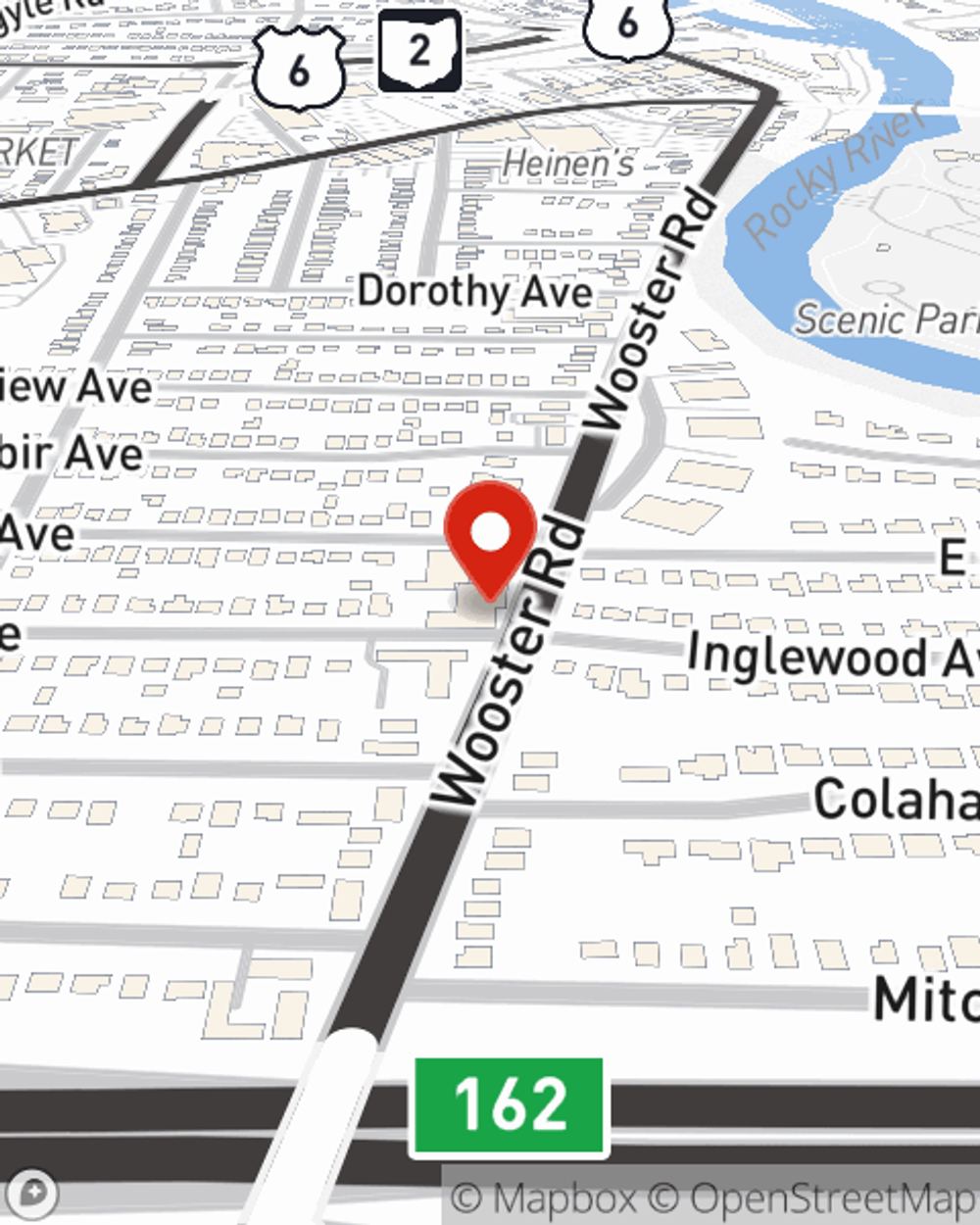

Business Insurance in and around Rocky River

Looking for small business insurance coverage?

No funny business here

State Farm Understands Small Businesses.

Whether you own a a flower shop, a cosmetic store, or a tailoring service, State Farm has small business insurance that can help. That way, amid all the various options and decisions, you can focus on your next steps.

Looking for small business insurance coverage?

No funny business here

Cover Your Business Assets

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, worker’s compensation or surety and fidelity bonds.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Suzanne Parker is here to help you discuss your options. Reach out today!

Simple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Suzanne Parker

State Farm® Insurance AgentSimple Insights®

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.